Monthly Archives: October 2013

make sure your POS and/or Internet gateway doesn’t violate this rule

You can not attempt to authorize a credit card that has been declined unless you wait at least 24 hours. If you do you will not get to keep the funds!

If you do the cardholder’s bank can pull back the sale and there is nothing you can do about it because it is a MasterCard/Visa/Discover/Amex regulation. Do not confuse this with a chargeback!

Make sure that you tell your POS provider that their POS must be set to disallow a reauthorization attempt on a declined credit card until 24 hours from the decline has passed. If you enter orders in a virtual terminal gateway or receive orders in a shopping cart integrated to your gateway make sure you set the gateway to not allow reauthorization of a declined card until 24 hours has passed.

Below is a quote from an actual case.

I hope this email has been of some help to you.

“FNBO gave the correct reasoning as to why we had to return the funds to the issuer. The issuer of the card filed this compliance case because the merchant didn’t wait at least 24 hours after the initial decline before trying to reprocess the transaction. The merchant was paid for this transaction when it was processed on 6/9, so they are liable for this transaction. I understand you saying it was the cardholder processed the transaction online, however, there should be settings that their gateway provider can change so once a card declines it can’t be reprocessed for at least 24 hours. Yes, this is a rule set forth by The Card Associations and there’s no way around it. As FNBO said, we have no recourse.”

The cardholder probably had some issues with their card and the issuer filed this case in order to recoup funds they may have lost.”

Amex has updated some of their chargeback procedures

described in the video link below. Also attached is a merchant chargeback guide which gives a lot of good chargeback advice that is applicable for all bank cards.

Why Is the Common Core Movement Bad for America?

“Common Core” is really disturbing. Communism hear we come! Please read-very scary! read here

Sent this fax back to “Merchant Services” Glad I did. Disgusting

embarrasing fax attached

Initiatives offered by POS systems, exchanges etc. to use one of their “recommended” processors/misconceptions re: MC 3D Secure & Visa Verify

Initiatives offered by POS systems, exchanges

You probably occasionally get asked to use a processor that these POS systems, exchanges recommend. “Approved” processor means that they are getting a kickback of usually 35% or so on the monthly residuals paid on your merchant account. I have been getting quite a few of these accounts moving to me because of

-“discounts & incentives” offered by the POS systems, exchanges are added back to th processing fees so in effect there are no savings or incentives

-the “recommended” processors raise rates with no notice to merchants

-once your volume increases they are holding reserves without giving a date of when the reserves will be returned which is against MC/Visa/Discover/Amex regs

-they are using smaller acquiring banks that can’t handle large volume or address chargebacks properly. Only Matrix has been servicing ticketbrokers for over 10 years & we setup our acquiring banks very carefully to accept & properly service the ticketbroker industry.

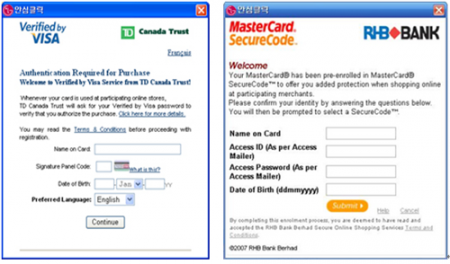

Misconceptions about MC 3D Secure & Visa Verify

These programs are setup for the benefit of the cardholder not the merchant. When the cardholder enters an eCommerce website to purchase they are given an option of filling out the form. If they don’t they can still complete the checkout process. Also at this point only a small percentage of issuing banks are enrolled. For unenrolled cards, the first person to use the card online gets to set the password. Identity thieves often know a victim’s date of birth or last digits of a social security number required for activation with the issuing bank. Cyberthieves are also well aware how easy it is to reset a 3D Secure password. Perhaps worst of all promises by MC/Visa to insure merchants against “friendly fraud” where the caroler receives the merchandise and wants to back out are being kicked back to the merchant through loopholes in the policies & procedures.

sample of online optional forms below